One Market, Two Phases: The Seduction Before the Submission

Remember 1997? When Britain handed Hong Kong back to China with the "One Country, Two Systems" deal? China told Hong Kongers "Keep your capitalism, keep your laws, keep your freedom. We're cool." It was like a partner reassuring you, "We can still see other people," then slowly making you delete all your dating apps.

The first few years were great. Hong Kong got unprecedented access to mainland Chinese markets, investment flowed like champagne at tech startups’ IPO parties, and everyone was making money.

But honeymoons don't last forever—and seductive promises often hide strings. 26 years later, another tempting offer landed at Hong Kong’s doorstep.

In May 2023, KeeTa, a food delivery app backed by Chinese tech giant Meituan, stormed into Hong Kong with an offer that seemed too good to be true: $300 sign-up bonuses, practically free delivery, and no subscription fees. For restaurants? Dirt-cheap commission rates that made delivery apps Deliveroo and Foodpanda look like loan sharks.

It was like watching a dealer hand out free samples at the playground. Except the playground was Hong Kong's $8 billion food delivery market, and the dealer wore a bright-green jacket and a helmet with a kangaroo logo on it.

But here's the thing about seemingly generous market entrants: They're like the charming date who showers you with gifts, only to show their true colors once you're emotionally invested.

The Perfect Market for a Takeover

Before we dive into KeeTa's playbook, let's talk about why Hong Kong was the perfect target. Imagine a market where:

📱 90 percent of people order food delivery at least once a week

💰 The average order value is higher than in most other Asian cities

🏢 A dense urban environment makes delivery efficient

🍜 There’s a strong food culture with almost endless restaurant options

Phase 1: The Honeymoon (a.k.a the Seduction)

KeeTa's current strategy is like watching a sugar daddy on a first date:

🤑 $300 sign-up bonuses (practically throwing money at you)

📦 Nearly free delivery (because who doesn't love free stuff?)

🏪 Rock-bottom commission rates for restaurants (10–15 percent when everyone else charges 25–30 percent)

⏰ 15-minute delivery guarantee (faster than your commitment issues)

🍱 "Meal for One" programs (because they know your dating life is dead)

They've already snatched 40 percent of the market. In less than a year. That's aggressive.

The Secret Sauce? Deep Pockets and Zero F***s Given

How can KeeTa afford burning all this cash?

Two words: Meituan money. Having China's delivery giant as your sugar daddy means you can lose money longer than your competitors can stay solvent. It's like bringing a nuclear weapon to a knife fight.

And it's working. Deliveroo already waved the white flag and left Hong Kong in March 2025. Foodpanda's sweating bullets, watching their market share evaporate.

But Here's Where It Gets Interesting...

Let's talk about the elephant in the room: this strategy is just not sustainable. Just look at DoorDash's numbers:

2022: Lost $1.36 billion (ouch)

2023: Still bleeding money

2024: Finally squeezed out a profit (after years of financial hemorrhaging)

And how did DoorDash finally turn profitable? They did exactly what your friendly neighborhood drug dealer does: jack up the prices once you're hooked.

The Economics of Delivery (Or: Why This Can't Last)

Here's some math:

Average delivery cost: $8–10

Current delivery fee: $2–3

Commission needed to break even: 25–30 percent

KeeTa's current commission: 10–15 percent

You don't need to be a Wall Street quant to see these numbers don't add up.

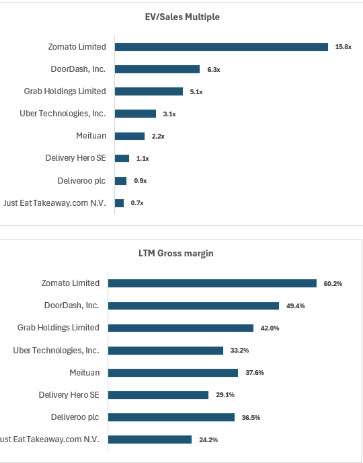

As can be seen from below charts, gross margins and revenue growth are key drivers of value for the food delivery and ride hailing companies. As such, if Meituan want ROI, KeeTa would eventually need to move on to phase 2 (see next section).

Source: S&P Capital IQ

Phase 2: Reality Hits (a.k.a The Submission)

Here's where KeeTa's true game plan comes into focus. Once they've got Hong Kongers fully submissive to their low-price seduction (and they're surrendering fast), they'll have to do what every delivery app eventually does:

Kill the subsidies (bye-bye, free money)

Raise commission rates to 25–30 percent (sorry, restaurants)

Squeeze more money out of existing users (hello, subscription fees)

Add "premium" features that used to be standard (want your food hot? that'll be extra)

Introduce surge pricing

Sound familiar? It should. It's the same playbook China used with Hong Kong post-1997. First comes the generosity, then comes the control.

So What's the End Game?

Think about it: Once KeeTa dominates the market and competitors like Deliveroo (who already peaced out) are gone, where else are restaurants going to go? Where else are hungry Hong Kongers going to turn for their 3 a.m. dim sum fix?

It's the same story we've seen before: today's generosity is tomorrow's leverage. Once they've got you hooked on the convenience and their brand imprinted in your psyche, they've got you hooked for life.

The Kicker

Here's the real mind-bender: everyone knows this is happening. The restaurants know it. The customers know it. Even the regulators probably know it. But like a frog in slowly boiling water, we're all too comfortable with the current temperature to jump out.